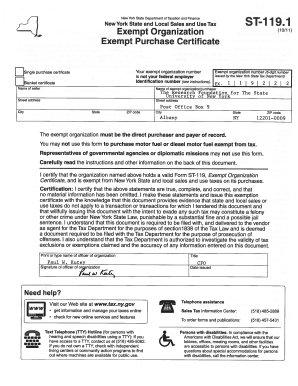

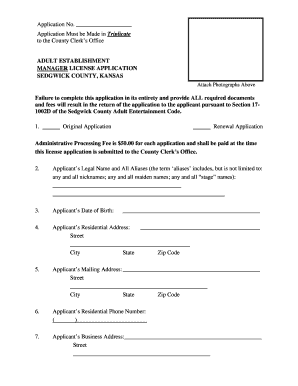

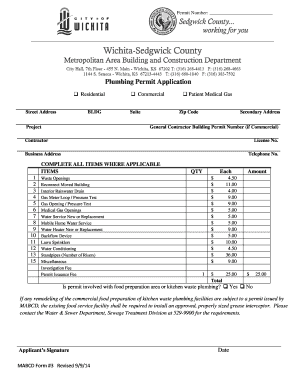

Get the free form 1191

Get, Create, Make and Sign

How to edit form 1191 online

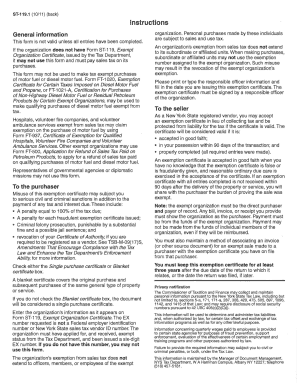

How to fill out form 1191

How to fill out form 1191:

Who needs form 1191:

Video instructions and help with filling out and completing form 1191

Instructions and Help about form 1191

Well you can#39’t stop progress it's not question of stopping it so much is just keeping up with it but IBM our work is related to the paperwork explosion specifically the paper work in an officeyouyoupaperwork explode has always been a LOOF maple work in an office, but today there is more paperwork than ever beforethere'’s more than ever before certainly more than there used to be in the past there always seemed to be enough time and people to do the paperwork there always seemed to be enough time to doth paperwork there always seemed to be enough people to do the paperwork there always seemed to me enough time and people to do the paperwork what today there ISN#39’t today there isn't enough time today there arena#39’t enough people today everyone has to spend more time onpaperworkmanagement has to spend more time on paperwork secretaries have to spend more time on paperwork companies have to spend more time on paperwork salesmen brokers engineers accountants lawyers supervisors doctors executives teachers office managers bankers former bookkeepers everybody has to spend more time on paperwork seems to me, we could use some help, so anyway I understand that IBM has a cordless dictating umadpsyllid IBM CT st can type 150 words minute ever free promote the IBM office products division representative explain how it worked dick taste Lander's to Diamond what Botha means by error free dictation Think I'll call it I am has always bee none of the leaders in the field of office equipment a guy bought a machine at IBM makes call them ST a whole line of IBM office products throughout the office IBM can help you with the time intakes to do the paperwork with IBM rotational Clement I can get four times as much thinking recorded as can't buy writing it down and twice as much as I can by dictating my skills secretary now the IBM CT st hair turns rough draft into error free copy automatically at the rate of a page every two minutes you systematically brought an office these are IBM machines can increasepeople'’s productivity about 50% and forth thinking that requires printed distribution there's the IBM selectriccomposer IBM machines can do the work so that people have time to think machines should do the work that#39’s what they're best at people should do the thinking that's what they're best at machines should work the people should think machines should work he own machines you should work people sheathings, so I don't do much work anymore'm too busy thinkingyouyou

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 1191 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.